What Are Derivatives? Futures vs Options Explained

If you’ve ever booked a holiday months ahead just to lock in a flight price, you already understand the idea of derivatives. In markets, they work the same way. Contracts that take their value from something else, whether it’s a stock, a barrel of oil, or even a currency. You don’t own the thing itself, but you can still benefit (or lose) depending on where its price goes.

So, What Exactly Is a Derivative?

A derivative is simply a deal between two parties. The deal is tied to an “underlying” — maybe corn, maybe the FTSE 100, maybe the euro/dollar exchange rate. The contract spells out terms: price, date, what happens if X or Y occurs.

Why bother? Three main reasons usually:

- Farmers, airlines and big companies use them to hedge, or protect themselves against price swings.

- Traders use them to speculate, hoping to guess right and profit.

- And then there’s leverage, controlling a large exposure with a relatively small outlay.

It’s a shortcut to get exposure to price moves without owning the actual asset.

Futures: Fix the Price, Whatever Happens

A futures contract is a promise to buy or sell something at a set price on a set future date. Imagine ordering coffee pods on Amazon today that will be delivered in a weeks time at today’s price. Whatever happens to coffee prices in the meantime, you and Amazon stick with the agreed price because you already paid for it (or will pay in cash at the time of delivery).

Markets work in the same way. An airline, for example, might buy oil futures at $60 a barrel for December delivery. If oil climbs to $80, they’ve saved themselves a fortune. If oil drops to $40, they’re stuck paying more than the going rate. That’s why budgeting is key!

Futures show up in commodities, indices, currencies. They’re exchange-traded, and instead of paying the full value up front, you put down a margin. That’s where leverage comes in, and where small price moves can quickly snowball into outsized losses.

Options: Choice Without the Chains

Now, options are a bit friendlier. They give you the right (literally option) but not the obligation to buy or sell at a set price before a certain date. Think of it like paying a booking fee to hold a concert ticket. If prices go wild, you can grab it and resell. If nothing happens, you walk away, fee lost, no strings attached!

There are two types of options: calls (the right to buy) and puts (the right to sell).

Take a simple example: you pay $100 for a call option to buy a stock at $50 within a month. If the stock jumps to $70, you exercise it, buy at $50 and sell at $70. If the stock never crosses $50, you do nothing, the most you lose is the $100 premium. Options are flexible that way: capped downside, open-ended upside.

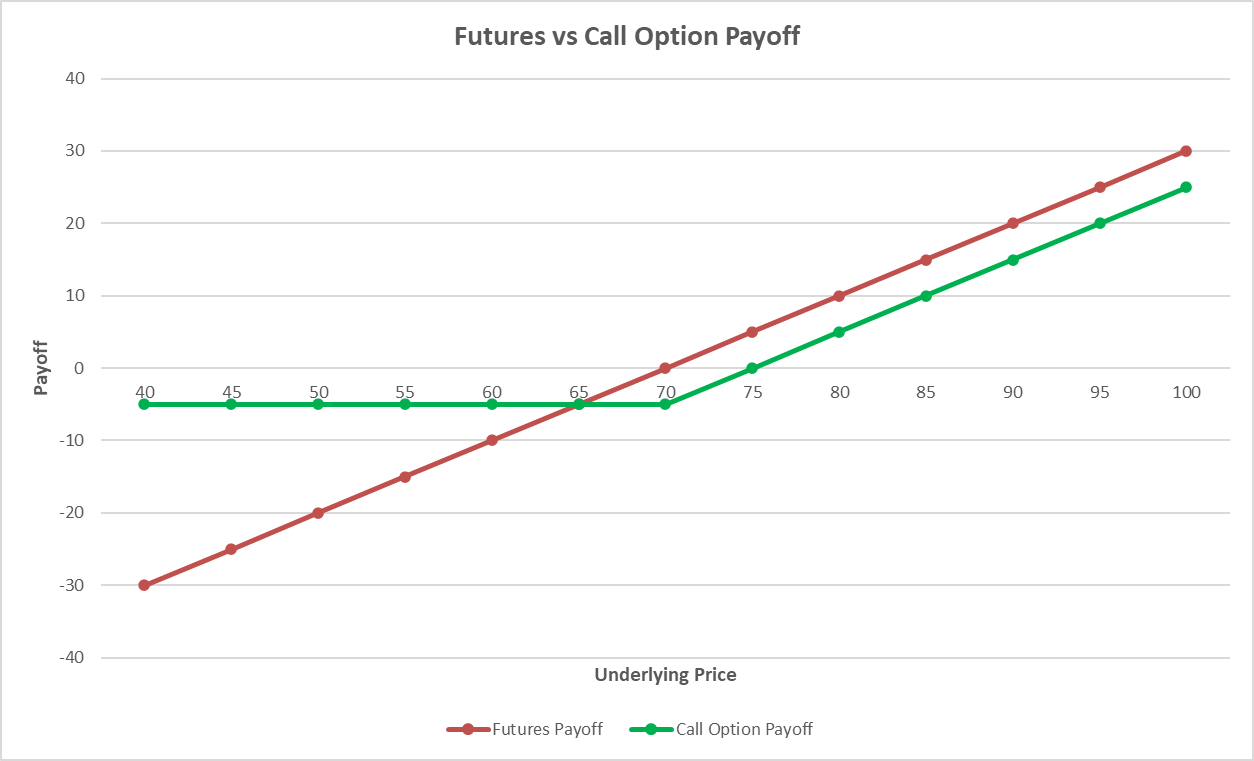

To make the difference clearer, the illustration below compares the payoff of a futures contract with that of a call option. Notice how the futures line rises and falls directly with the underlying price, while the option line stays flat until the strike price is reached, then slopes upward, showing its limited risk but unlimited upside.

Illustration: Comparing payoff profiles of a futures contract and a call option.

Why Does Any of This Matter?

Because derivatives are woven into daily markets, often in ways you don’t notice. Farmers use them to sleep at night, airlines to stop fuel bills from wrecking budgets, and portfolio managers to shield investments from downturns. Even retail traders dip into options to juice returns or protect stock positions.

The hook? You can control a big position for a small cost. The catch? That same leverage cuts both ways. It’s powerful, but in the wrong hands it’s a buzzsaw.

The Risky Bits

Derivatives are extremely risky instruments if you don’t know how to use them.

- A tiny move in the market can mean big wins or painful losses.

- With futures, you’re locked in. There’s no way out if prices crash.

- Options limit losses to the premium, but if you keep buying the wrong ones, the costs pile up.

- And remember, you don’t (and can’t) actually own the underlying asset, just a contract about it.

- On top of that, the concept of strike prices, expiries, margins, can be a tricky for beginners.

Bottom Line

Derivatives, whether futures or options, are everywhere. Futures give certainty by fixing prices but lock you in. Options hand you flexibility, letting you decide later. Both can be smart tools for hedging or speculation, and both can bite back if you underestimate the risks.

Used wisely, they add muscle to an investment strategy. Used carelessly, they’re a fast track to losses. The real trick is knowing which side of that line you’re standing on.