Healthcare as a Shelter: Defensive Sector or Growth Story?

Investors often think of health care as a “safe harbour” – people need medicine whether the economy booms or busts. But the picture in Q2 2025 is mixed. Over the past year health-care shares have lagged the wider market, leaving valuations near multi-year lows. That has caught some bargain-hunters’ eye: the S&P 500 Health Care index was flat in early 2025 while the S&P 500 gained around 7%. At the same time, the sector is home to new blockbuster drugs and AI-driven innovation. In short, health care is playing both roles – steady defensive sector and potential growth story. So which wins out?

Key Drivers

- Policy and politics. In the US, the previous administration pushed measures like drug-price negotiations and cuts to research funding and Medicaid. That regulatory fog has kept investors cautious. A new administration could ease some of that pressure – for instance by raising reimbursements for Medicare Advantage plans. Europe and other regions have their own price controls and budget constraints, so policy shifts matter globally.

- Population and demand. Demographics are a powerful long-term driver. Populations are ageing everywhere, and older people already spend twice as much on health care as younger people. In the short run, the post-COVID catch-up effect has boosted surgeries and treatments, pushing up hospital volumes but also insurance costs. That surge is fading, but the structural demand trend remains upward.

- Innovation and sentiment. The sector isn’t just about steady dividends. Diabetes and obesity drugs like GLP-1 therapies have made Novo Nordisk and Eli Lilly market leaders. Biotech firms are producing gene therapies and using AI in drug discovery. Analysts project industry earnings growth of around 14% annually – well above the market average. Meanwhile, healthcare ETFs saw record outflows in 2024, leaving valuations unusually cheap. That discount alone is tempting value investors back into the space.

Fundamentals

Valuations are at rare lows. The forward P/E for the S&P 500 Health Care index sits around 16x, down from 20x a year ago, while the broader S&P trades above 22x.

Earnings power, however, remains intact. Drugmakers enjoy high margins thanks to patents. Device companies spend heavily on R&D but secure steady revenues. Insurers and hospital chains are more volatile, with profits tied to cost control. Insurers in particular struggled in recent quarters as Medicare costs outpaced premiums. Still, analysts expect solid growth ahead, with long-term projections of mid- to high-teens earnings growth supported by pricing power and innovation.

Balance sheets are generally strong. Pharma giants hold large cash reserves, most are investment-grade, and many companies continue to pay dividends or buy back stock. Equipment makers carry debt but benefit from reliable orders, while hospitals and insurers are required to maintain reserves. The sector overall has the financial flexibility to absorb shocks.

Macro Tailwinds and Headwind

On the positive side, ageing populations guarantee structural demand. Technology is stretching R&D dollars further. If inflation cools, labour and supply costs may ease, and with central banks turning dovish, growth names like biotech get a valuation lift.

On the flip side, health care is never free from politics. US pressure to lower drug prices may persist. European governments face strained budgets, limiting spending growth. A global recession would weigh on elective procedures, while stubborn wage growth could keep margins under pressure. Currency swings and supply-chain risks add to the uncertainty.

Regionally, the US has the highest margins but the heaviest policy overhang. Europe and Japan are more state-controlled, offering stability but less growth. China and other emerging markets are still expanding rapidly, though policy swings and price caps make them unpredictable.

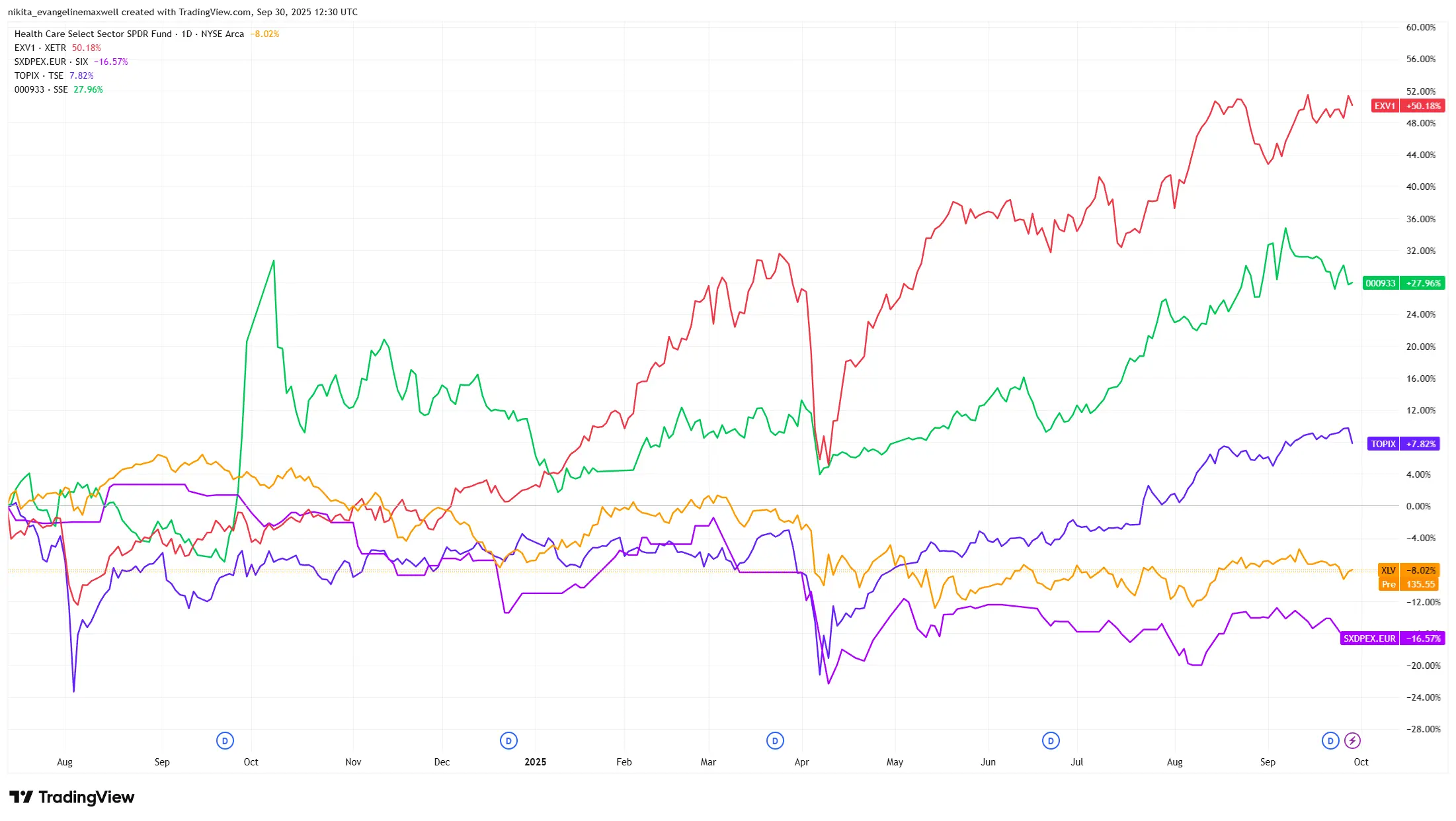

Regional Healthcare Sector Performance (2024-2025)

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 September 2025.

Risks

The biggest risk is a policy shock – sudden drug-price caps or deep Medicare cuts could erase much of the sector’s valuation appeal. A second risk is earnings disappointment: insurers have already warned of rising medical costs, and if obesity or diabetes drugs underperform expectations, growth hopes could falter. Sentiment is another: with record ETF outflows, investors may continue to shun the sector despite cheap valuations. Add in potential geopolitical disruptions or pandemics, and risks remain real.

Final Takeaway

Health care today is both a bunker and a launch pad. Its defensive side – essential demand, steady cash flows, healthy balance sheets – makes it a stabiliser when markets turn rough. But innovation, demographics, and low valuations give it genuine growth potential too. After years of underperformance, the sector looks tempting again, though policy uncertainty and cost pressures haven’t gone away. For investors, the smart approach is to view health care not as one label – “defensive” or “growth” – but as a diverse field where both safe, dividend-paying names and high-flying innovators coexist.