A Dovish Fed Sparks Rotation | Weekly Recap: 18 Aug – 22 Aug 2025

Economic Overview

Markets spent the week waiting for Jackson Hole, and Powell didn’t disappoint. His message was softer than many feared: the Fed now sees the balance of risks shifting, and he even opened the door to a September cut. That was enough to steady nerves after five straight down sessions for Wall Street. By Friday, the Dow was at record highs, the S&P 500 rose, and only the Nasdaq lagged as tech finally cooled.

The data backdrop actually looked stronger than expected. US flash PMIs jumped, with the composite at 55.4 – the best in nine months – and manufacturing back in expansion at 53.3. That’s not less, considering July was still in contraction. Services held up too, though companies flagged the sharpest rise in costs since early 2023, largely thanks to tariffs! It’s a tricky mix – with activity picking up, but inflation pressures still in the background, Powell acknowledged both, but chose to lean more on the risk of a weaker labour market.

The UK had its own surprise. CPI came in at 3.8%, higher than expected and the tenth straight overshoot. Airfares were the big culprit, up nearly a third MoM, and food and fuel prices added to the squeeze. For the BoE, which only just cut rates to 4.0%, that makes the near-term path weird. Markets have pushed the next cut into 2026.

Across the Channel, the eurozone flashed a little optimism. The composite PMI rose to 51.1 – the first sign in over a year that momentum is turning. Manufacturing, incredibly, crept back above 50 for the first time since 2021, with Germany leading the rebound. The caveat: service-sector inflation stayed hot, which explains why the ECB is reluctant to hint at cuts.

China remained the outlier. July’s numbers showed a slowdown: industrial output at its weakest in eight months, retail spending slowing, and loan growth actually contracting YoY for the first time in two decades. The PBoC stayed on hold, preferring targeted tweaks. A tariff truce extension with Washington helped sentiment a bit, but not much more.

Equities, Bonds & Commodities

The S&P 500 was barely positive, up 0.2%, but the Dow gained 1.6% as value stocks carried the load. The Nasdaq fell 0.3%, showing how the “magnificent” tech rally is taking a breather. Europe did better. The STOXX 600 climbed almost 2% thanks to stronger PMIs, and London’s FTSE 100 notched another record, up 2% on the week. Asia was mixed – China’s market clawed back 1.4% while Japan slipped slightly as a firmer yen dented exporters.

Bonds rallied once Powell spoke. The US 10-year yield eased to 4.26% and the 2-year dropped to 3.68% (its lowest in a month). That steepened the curve a little, a welcome change from the deeply inverted backdrop. In the UK, gilts spiked mid-week on the inflation surprise but settled back to 4.7%. Bunds drifted lower as investors digested Europe’s mix of better growth and persistent price pressure.

Commodities had a better run. Brent crude snapped a three-week losing streak, climbing 2.9% to just under $68. US inventories fell more than expected, and Russia-Ukraine peace talk headlines didn’t amount to much. Gold was flat for the week, near $3,373 an ounce, but Friday’s jump showed how sensitive it is to dollar moves.

Bitcoin lived up to its volatility tag: down 5% mid-week, then surging back above $115k after Powell, finishing only 1% lower.

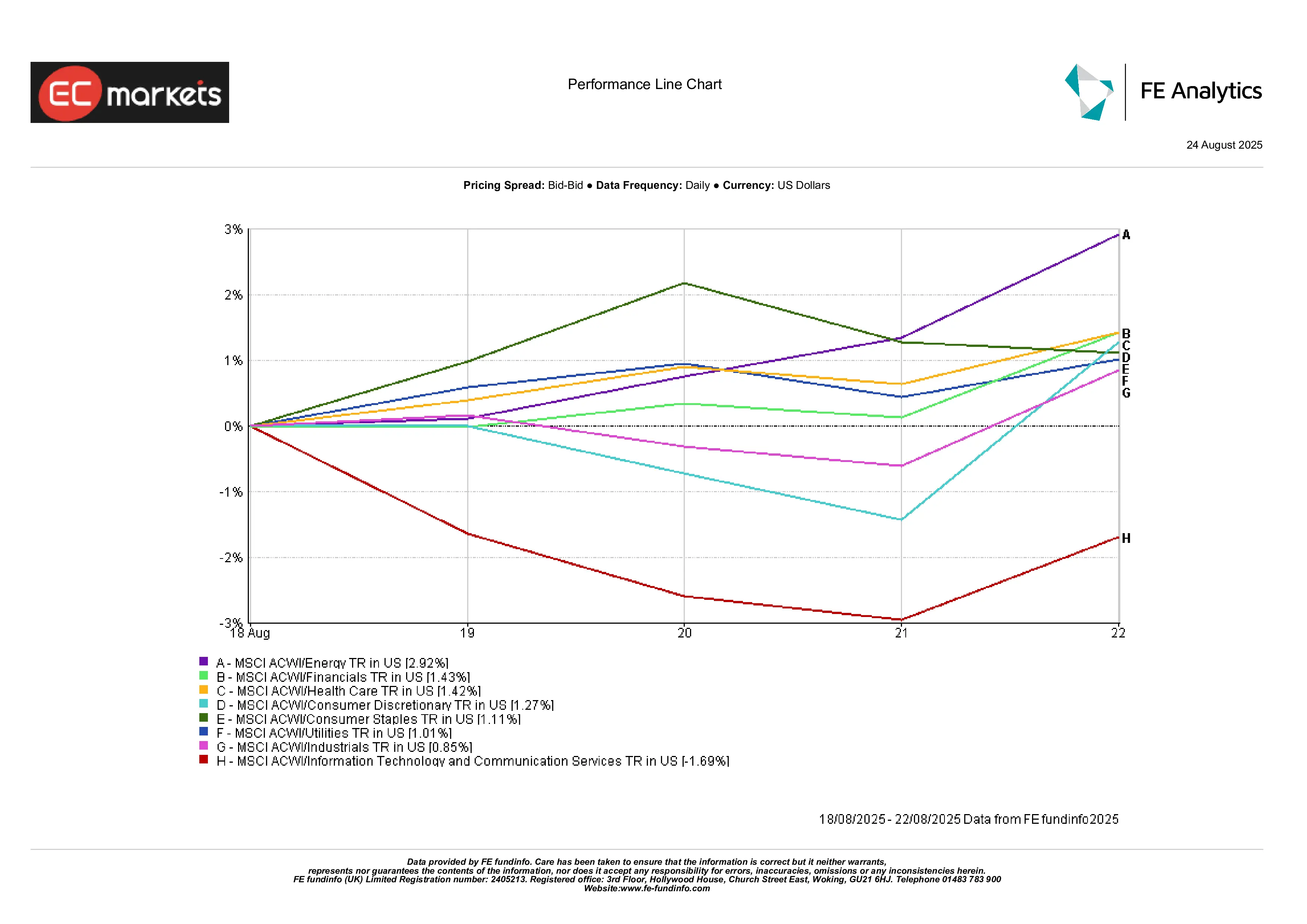

Sector Performance

It wasn’t tech’s week. Energy led with a 2.9% rise, supported by the oil rebound. Financials and Healthcare also posted gains of about 1.4%. Consumer Discretionary and Industrials added modestly. Tech and Communications, however, both slipped around 1.7%.

In short, market leadership finally broadened – something bulls have been waiting for after months of narrow gains led by mega-cap tech.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 22 August 2025.

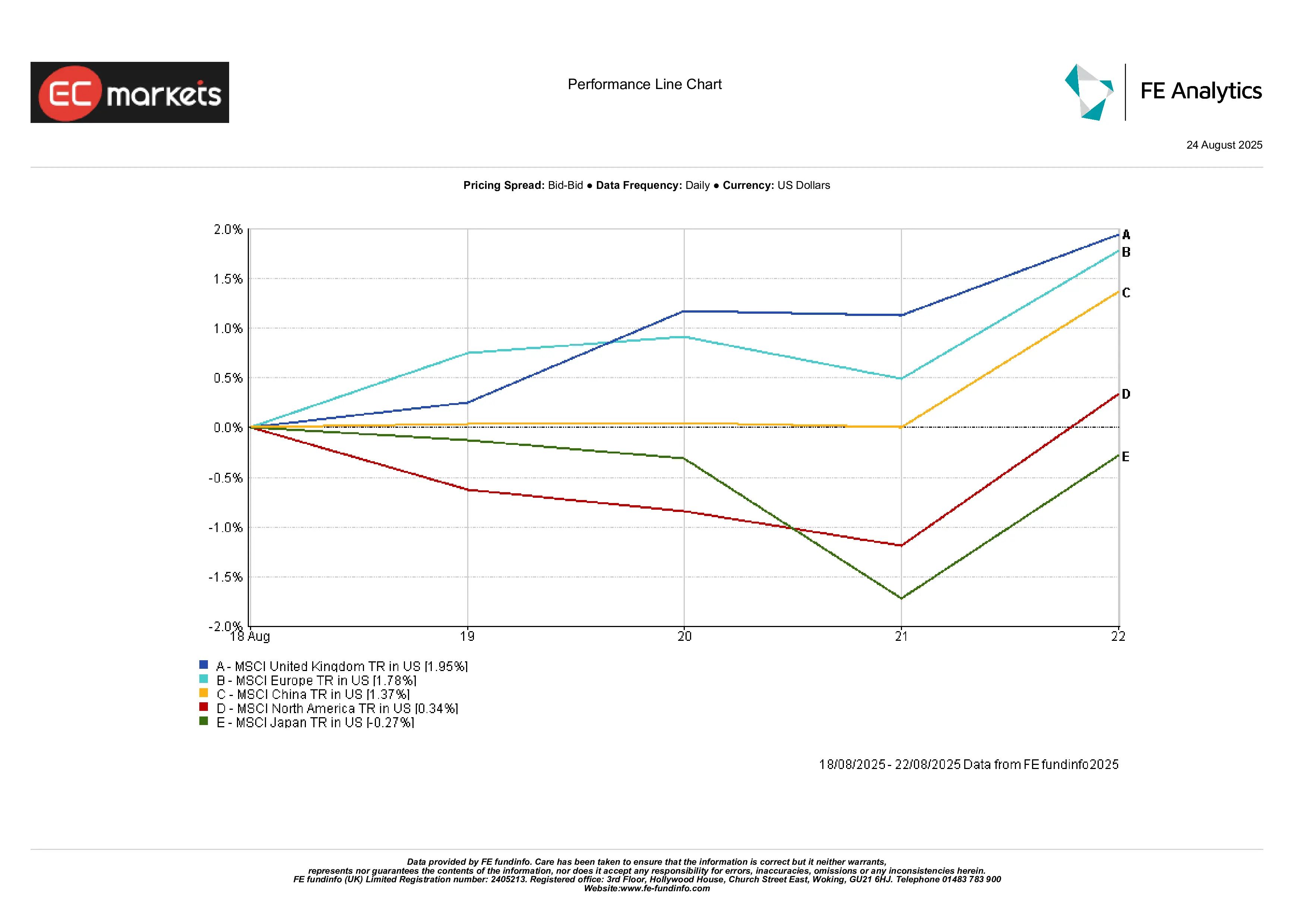

Regional Markets

The UK stood out, with MSCI UK up 2%. Europe wasn’t far behind, adding 1.8% on stronger PMIs. China managed a 1.4% rise despite soft data, helped by speculation of more support. Japan dipped 0.3%, a rare underperformance after a strong year-to-date run. North America as a whole was flat, dragged by the Nasdaq’s stumble.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 22 August 2025.

Currency Markets

The dollar finally lost some altitude. The DXY index fell about 1% on the week, its sharpest drop in months, after Powell’s dovish signal pulled US yields lower. The euro gained ground, finishing at 1.1717 versus 1.1661 on Monday, supported by stronger eurozone PMIs. The pound also pushed higher, closing the week at 1.3527, keeping it well above 1.30 despite the upside inflation surprise – markets see the BoE pausing rather than tightening again.

The yen also strengthened. USD/JPY slipped from 147.9 to 146.9, a 0.6% move that underscored the dollar’s weaker tone. Crosses showed the same shift: GBP/JPY dipped from 199.7 to 198.8, highlighting yen resilience even against stronger sterling. Elsewhere, commodity and emerging-market currencies caught a bid – the yuan steadied after weeks of pressure, the Aussie dollar firmed alongside oil and metals, and the rupee found some relief. The theme was broad dollar softness, and whether it carries on will hinge squarely on next week’s US PCE inflation release.

Outlook & The Week Ahead

The last week of August is a big one. In the US, Thursday brings the Q2 GDP revision and Friday delivers the July core PCE deflator – the Fed’s preferred inflation gauge. A softer PCE would all but lock in a September cut. A hotter one would complicate things. And then, right after, the August jobs report arrives on 1 September, giving markets almost no time to digest before the long weekend.

Europe’s focus will be on inflation too, with flash CPI prints likely to set the tone for the ECB. In the UK, the calendar is lighter, but any BoE commentary will be dissected for signs of discomfort with July’s CPI miss. In Asia, China’s PMIs are front and centre: another weak showing would reinforce concerns about the depth of its slowdown.

Beyond data, oil traders will be watching OPEC+ after Brent’s rebound, and geopolitics is still a swing factor with Ukraine talks going nowhere. With September around the corner, seasonality and higher volumes could bring more volatility. Powell’s signal helped markets end August on a high, but valuations remain stretched. Traders may find that the next move depends less on central bank words and more on whether the data co-operate.