Fed Pivot, China Cues Lift Risk Appetite | Weekly Recap: 22-26 Sept 2025

Economic Overview

Markets spent most of last week stuck between two narratives: inflation that remains stubbornly high and a Fed that finally made its first cut since late 2024. August’s PCE numbers came in as expected with core prices up 0.3% on the month, 2.7% YoY. Not exactly encouraging, but not worse than feared either. It was just enough to calm nerves after the cut, though investors were left second-guessing whether this was the start of an easing cycle or simply a cautious adjustment.

Fed commentary didn’t bring much clarity. Add in the fact that Q2 growth was still solid, and traders were left wondering: is the Fed really ready to go all-in on easing? The outcome was choppy trading across asset classes with equities swinging between mild losses and quarter-end support, while bonds failed to find a clear direction.

The UK told a familiar story. The BOE left Bank Rate at 4%, pointing to sticky prices. August CPI at 3.8% (the highest in the G7) reflected stubborn food and services costs. In the eurozone, Christine Lagarde also opted to hold the deposit rate at 2%, striking a cautious but steady tone. Inflation has cooled toward target but firmed slightly in September, enough to keep the ECB patient.

China offered a different angle. Industrial profits for Jan-Aug finally moved back into positive territory, up 0.9% YoY after months of decline. Policymakers in Beijing promised “appropriately loose” conditions and better fiscal-monetary coordination, but investors remain unconvinced without bigger stimulus. Weak retail and factory numbers reinforced that scepticism. By Friday, though, sentiment had improved, with risk appetite creeping back even as growth concerns hung in the background.

Equities, Bonds & Commodities

Wall Street closed the week on a steadier note after the PCE numbers reassured investors. Even though on Friday the Dow added 0.65% to finish at 46,247, the S&P 500 rose 0.59% to 6,644, and the Nasdaq gained 0.44% to 22,484, they hid a softer weekly story: the Dow slipped 0.2%, the S&P lost 0.3%, and the Nasdaq fell 0.7%. Tech bore the heaviest selling as investors locked in summer gains.

In Europe, equities showed the same mixed tone. The FTSE 100 was essentially flat, with energy and miners balancing weaker consumer and domestic sectors. The STOXX 600 dropped 0.4% as med-tech and defensives dragged, partly offset by firmer telecoms and utilities. Investors stayed wary given sluggish PMIs and inflation that refuses to budge.

Asia wasn’t much better. Japan’s Nikkei slipped 0.4% after lacklustre industrial data, while Chinese equities also edged lower, with the MSCI China index down 0.4% despite renewed stimulus chatter. Regionally, North America lagged most, with the MSCI index down 0.8% as US tech led the pullback.

Bond markets were steadier. The 10-year Treasury yield closed near 4.17%, only slightly higher, while the 2-year held at 3.66%. The curve stayed inverted, underscoring doubts about how far the Fed can ease without reigniting inflation. UK gilts hovered in the mid-4% range and German Bunds around 2.5%.

Commodities were firmer. Brent crude settled at $69.42, up 2% across the week, helped by OPEC+ supply discipline. Gold extended its run, rising 0.4% to $3,750 an ounce, leaving bullion roughly 11% higher on the month.

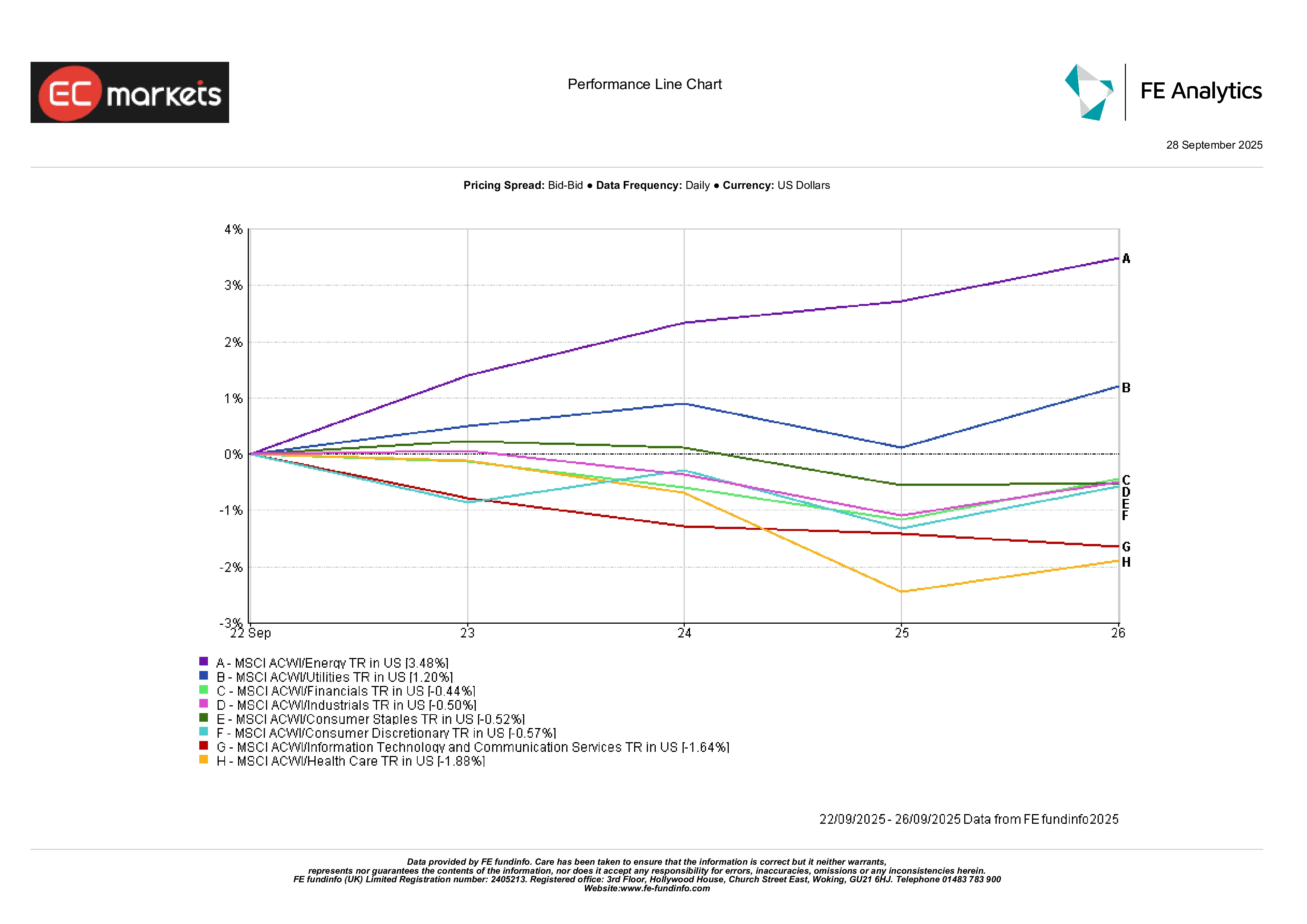

Sector Performance

The MSCI ACWI sector breakdown showed clear winners and losers. Energy led the pack with a 3.48% gain, fuelled by oil’s rise and renewed interest in cyclical plays. Utilities followed with a 1.20% lift as falling yields boosted the appeal of steady dividends. Financials, despite slipping 0.44%, outperformed relative to peers as banks found support from yield-curve dynamics.

At the other end, growth-heavy sectors lagged. Information Technology and Communication Services slid 1.64%, as investors rotated out of pricey names. Health Care lost 1.88%, the weakest showing of the week, with defensive demand fading. Consumer Discretionary dropped 0.57%, hit by profit-taking after a strong run. Staples and Industrials each hovered near flat, underscoring a market in rotation rather than outright retreat.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 26 September 2025.

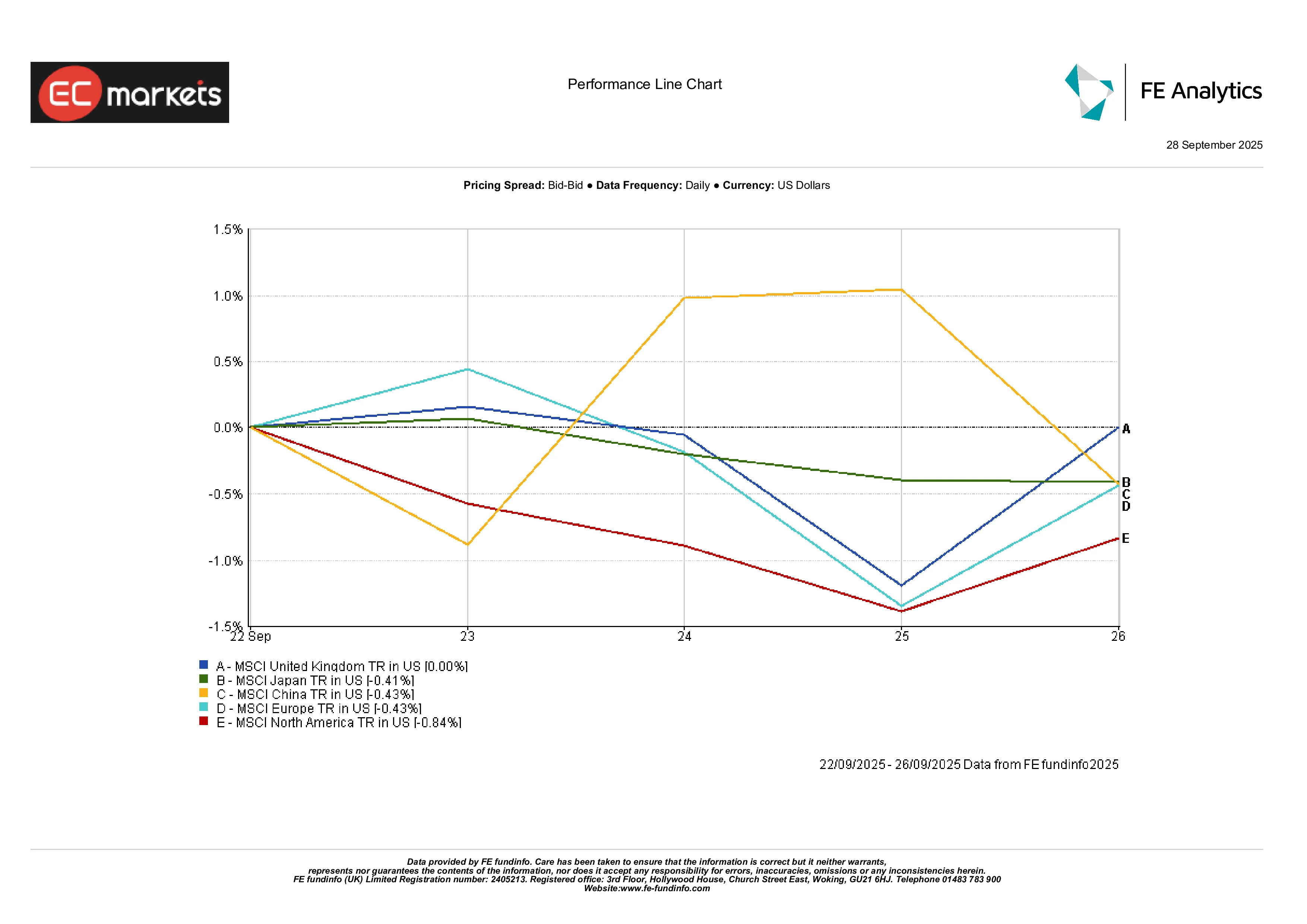

Regional Markets

Regional returns highlighted divergence. North America lagged with a decline of 0.84%, its tech exposure proving a drag. China and Japan both slipped around 0.4%, weighed by weak data and limited policy traction. Europe matched that 0.4% drop, reflecting cautious business surveys and inflation sticking near target. The UK stood out as the only flat performer, helped by its resource-heavy composition. In short, North America led losses, while the UK managed to hold ground.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 26 September 2025.

Currency Markets

Currencies echoed policy divergence.

Sterling strengthened as inflation concerns kept the BoE wary of cuts. GBP/USD ended at 1.3405, up 0.45% on Friday, while GBP/JPY climbed nearly 1% to 200.41.

The euro also gained modestly, with EUR/USD finishing at 1.1702, up 0.30%, aided by firmer inflation and stable ECB rhetoric. The dollar slipped against both, though it held relatively steady elsewhere.

USD/JPY fell to 149.51, down 0.19%, as risk sentiment nudged investors back toward the yen.

Overall, sterling was the week’s strongest G10 currency, while the dollar softened on dovish Fed undertones.

Outlook & The Week Ahead

Attention now turns to fresh data and central bank speeches. China’s September PMIs, due Tuesday, will offer an early look at whether policy nudges are working. That same day, the UK reports its final Q2 GDP, followed by Germany’s preliminary CPI. On Wednesday, eurozone flash inflation takes centre stage, before the week closes with the US nonfarm payrolls report on Friday. Markets will also parse speeches from Fed, ECB and BoE officials for hints of the next policy steps.

The backdrop remains one of cautious optimism. Inflation is still sticky, but the bias toward looser policy is intact. Investors are balancing the appeal of cheaper money with concerns about slowing growth, leaving markets sensitive to surprises. If incoming data confirms moderation, the risk-on tone could build into October. But any upside shock in prices (or geopolitical flare-up) would quickly remind traders that the path to easier conditions is anything but smooth.